Electricity Distribution Sector Report

1. Introduction

Historically, different states have opted to provide electricity utility services directly by public-owned enterprises and similar government bodies to ensure fair price and quality in such a market with critically sensitive nature. However, over time, this resulted in inefficiencies to occur due to the less-effective methods of public administration and brought excess burden on states. Additionally, lack of competition - a fundamental aspect of network economies – meant that the electricity supply chain was never as effective as it could have been otherwise. To mitigate these issues, states chose to privatize and liberalize the electricity utilities. Electricity distribution networks’ fate has been one of the most debated aspects of this shift towards liberalization.

Opening up various levels of the electricity supply chain to competition, or in other words allowing entry of additional producers and retail suppliers to the equation, added dynamism and competitive pressure to the electricity market. Distribution of electricity, however, would not change in appearance as drastically as the production and supply levels due to its nature.

As a typical network industry, electricity distribution market is a market demonstrating typical economies of scale characteristics. To be able to transport electricity to consumers around the grid, an investment must be made in a huge network of electricity lines stretching throughout the country to each consumption point. The fixed cost of this investment is considerably high. This means that the market is subject to a constant market failure due to the existence of a natural monopoly; the market is better off with a single electricity distribution infrastructure and it is unreasonable to invest in establishing any additional parallel networks since it would result in massive reduction in overall welfare.

Accordingly, the market must be regulated to ensure the electricity distribution is conducted by a single firm by way of limiting entry to the market. However, given that this monopolistic firm will hold the entire distribution services in its very hand, the freedom this firm might possess also has to be somewhat limited, lest the consumers may face unjustified high prices or lacking quality in services. The disposition of protecting the electricity consumers as well as the public welfare as a whole results in the necessity for regulation. Thus, the electricity distribution market is subject to a varying degree of regulations worldwide.

In Turkey, following a long but rushed process of liberalization explained below, electricity distribution has been privatized and is subject to heavy regulations. Electricity distribution activity is primarily subjected to license. Acquiring and maintaining the relevant distribution license has been linked up to strict criteria. License holders, or distribution companies in other words, are subjected to numerous obligations and duties they must perform while operating the distribution network. Additionally, the issues arising from distribution companies in a particular region and their sister companies that are the incumbent retail supplier in the relevant region acting in unison to maximize their gains while utilizing discriminatory practices towards other third parties active in the market has been addressed by unbundling obligations enforced.

This report examines the history of Turkish electricity distribution market and the metamorphosis it had went through, provides the legal framework through which the sectorial regulations are implemented, and lists the rules concerning electricity distribution companies and their obligations.

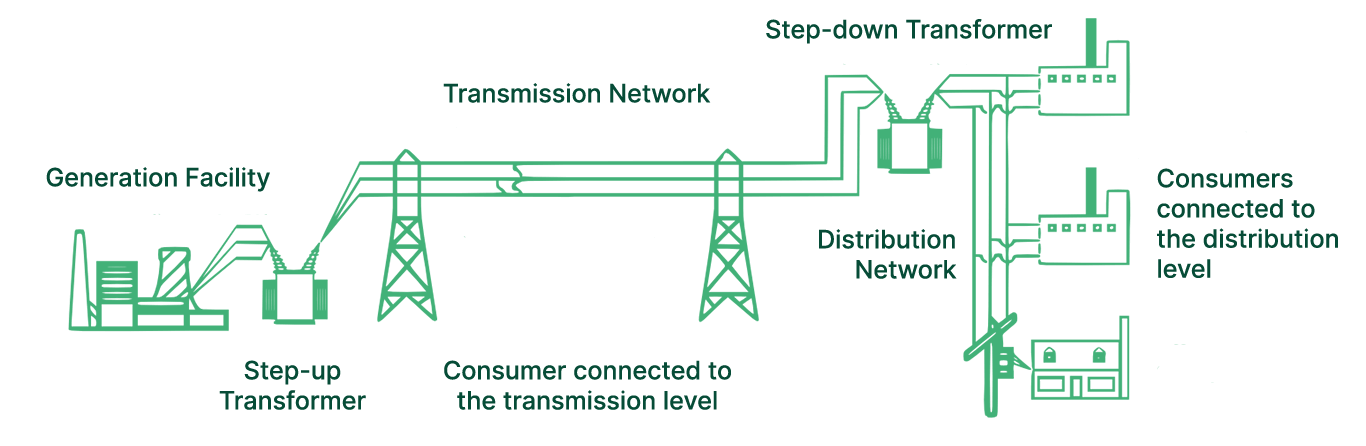

2. Definition of Electricity Distribution

First of all, providing a clear-cut definition of electricity distribution is essential for understanding the regulatory framework surrounding it. Electricity distribution is the activity of delivering electricity to the end consumers. Distribution activity is carried out by transporting electrical energy at medium and low voltage levels. Unlike transmission activities, there is no benefit or obligation to integrate the distribution network with production/generation activities. A distribution network transmits the electrical energy to the consumer by taking it from the transmission system and reducing it to a low voltage level suitable for consumption.

Distribution networks also display natural monopoly characteristics like transmission networks. Unlike the transmission network, distribution networks can be structured as regional monopolies by dividing them into regions.

Distribution networks also display natural monopoly characteristics like transmission networks. Unlike the transmission network, distribution networks can be structured as regional monopolies by dividing them into regions.

3. History of Turkish Electricity Distribution Market and Market Structure

To be able to comprehend how the current regulatory framework came to be, one should be informed about the recent history of the Turkish electricity market.

Chronological History

Electricity industry has functioned under various structures since the production of electricity began in our country. At first, a number of municipalities, local privileged companies and other state-owned entities existed throughout Turkey and supplied electricity without any unitary governance or regulatory framework. In 1970, Turkish Electricity Administration Law (Law No. 1312)[1] was enacted and entered into force in order to eliminate this dispersed structure in the electricity sector and to ensure business integrity. Along with Law No. 1312, Turkish Electricity Administration (TEK) was established and electricity production, transmission, distribution and supply activities were monopolized by this public institution, with the exception of certain local municipal bodies. In 1982, Law Amending Law No 1312 (Law No. 2705) further increased TEK’s authority in the market when network facilities and operations of residential units – or in other words, distribution networks – were entirely transferred to TEK’s ownership.

After 1982 and for over a decade, TEK was an administrative institution that oversaw the entire electricity utility in Turkey. TEK ensured electricity was produced, and it was also responsible for the establishment and maintenance of the entire grid network. Moreover, just like a private commercial entity – or a corporation – it supplied (sold) electricity to consumers. Electricity distribution under TEK was governed under a number of administrative zones, where smaller directorships were responsible from their local network[2].

During those years, winds of change swept by and liberalization became the new norm in market economies. This resulted in many states reforming their electricity market structure, making room for privatization and attempting to open up various segments of the electricity market for competition.

As a new step towards the liberalization trend, TEK was restructured under the new privatization policy adopted by the Turkish government in the late 1980s. In 1994[3], TEK was split into two separate entities, Turkish Electricity Generation-Transmission Corporation (TEAŞ) and Turkish Electricity Distribution Company (TEDAŞ). These two companies were state-owned enterprises. TEAŞ later on became TEİAŞ (Turkish Electricity Transmission Company). TEDAŞ became the monopoly for electricity distribution throughout Turkey.

During that time, many countries reformed their electricity market, most influential of which were the United Kingdom and Chile, and Turkey was influenced by these reforms[2]. Privatization became the dominant policy and gained a high number of followers in the political stage. At first, build-operate-transfer, build-operate and transfer of operating rights methods were generally utilized. This period brought many discussions along with it, resulting in a reign of convoluted concession agreements and a critical need for legislative reforms arose.

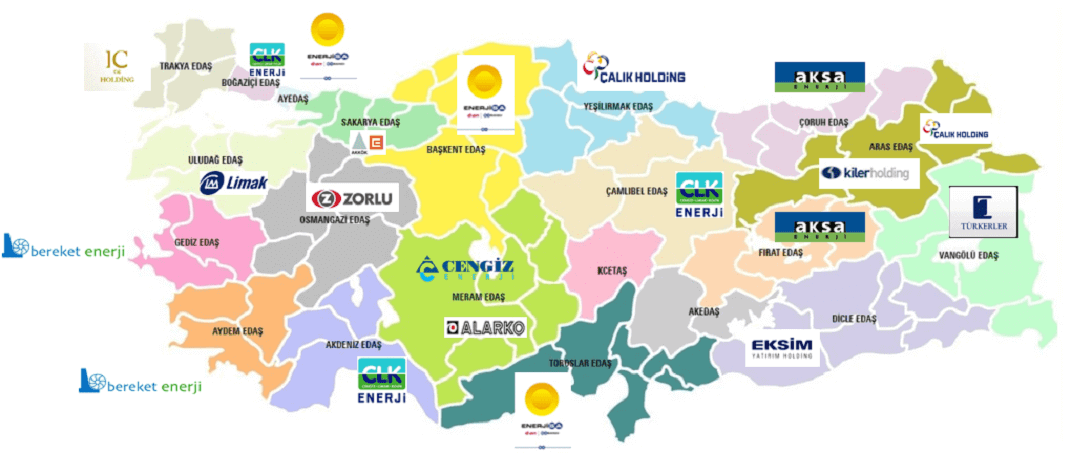

At this time, the Former Electricity Market Law (Law No. 4628) was promulgated, allowing electricity sector to properly be defined as a “market”. Different levels of the vertical chain were defined, Electricity Market Regulatory Authority was formed (later renamed as Energy Market Regulatory Authority), and an overall more liberal approach was adopted. The next step was to include distribution of electricity in the scope and program of privatization. In order to create a competitive environment in the electricity distribution and retail sales sector and to reform the market, it was decided to privatize the electricity distribution services by restructuring the public owned electricity enterprises on the basis of the distribution regions and TEDAŞ[5]. In 2004, distribution zones were re-specified, and Turkey was divided into 21 distribution regions. TEDAŞ’s assets and duties in these regions were transferred to private enterprises that won the privatization bids. It was initially envisaged that the distribution companies would be completely privatized by 31.12.2006, however the tenders were postponed and were held later in 2008-2010. Some of these tenders were annulled, requiring them to be re-arranged. In the end, as of 31.08.2013, share transfer agreements between these companies and TEDAŞ have been completed.

Currently, the distribution of electricity in Turkey is conducted through the 21 companies in 21 regions. These companies are monopolies in their respective regions. It should be emphasized that these companies are under the same ownership with the incumbent supply companies in their respective regions, albeit as different legal entities due to the unbundling obligations that will be explained below.

Benchmarks and Adopted Model

Turkish electricity market, and by extension the distribution network known today, is the result of the implementation of a certain restructuring model. This global benchmark, primarily observed in the UK, Chile and Norway and deemed successful could be examined under four main topics:

- The vertical unbundling of production, transmission, distribution and supply of electricity, and horizontal unbundling of production and supply levels alongside it – the restructuring of the market.

- Opening the wholesale and retail markets to competition and allowing new entries to the market in production and supply activities – competition and market formation.

- Regulation – including the establishment of an independent regulatory authority, third parties’ the right of access the network, the regulation of transmission and distribution activities, and the performance-based tariff structure to be applied to these activities.

- Enabling new private sector representatives to join the market and privatize existing public-owned activities – change of ownership.

As also listed under the World Bank’s sources[6] , the relevant reforms mainly consisted of the following stages[7]:

- Creating a reformist law that ensures liberalization in the electricity sector,

- Establishing an independent regulatory body for the industry,

- Corporatization of publicly owned enterprises,

- Vertical unbundling of main activities such as production, transmission, distribution and sales in a vertically integrated structure and ensuring the necessary horizontal unbundling regarding market activities,

- Providing third parties’ access rights to the network in natural monopoly transmission and distribution activities and applying performance-based regulation for these activities, as well as determining tariff structures,

- Formation of a competitive wholesale electricity market,

- Privatization of publicly owned assets and enterprises,

- Entry of independent electricity producers to the market,

- Liberalization of the retail sale of electricity,

- Defining the rules regarding consumer protection, incentives and privileges for energy, costs incurred and the formation of an environmentally compatible market.

In Turkey, the foregoing steps were followed over the course of the last few decades as explained in the previous section. Thus, electricity market was restructured from a publicly owned, vertically integrated monopoly to vertically separated and unbundled form we know today. Accordingly, distribution network has been transferred to private companies, and Energy Market Regulatory Authority (EMRA) was left in charge of overseeing the various subjects requiring regulatory attention, such as third parties’ access and consumer protection.

4. Legal Framework of the Electricity Distribution Regulations in Turkey

Electricity distribution is regulated under a broad framework of legislations. Other than the Electricity Market Law (Law No 6446), which is the main legal text, – there are various secondary legislations such as communiqués, regulations and EMRA decisions.

Former Electricity Market Law No. 4628 and EMRA

As a result of the process that foresaw liberalization in the electricity market explained above, as well as the need for the local regulations to be in line with the European Union legislations due to the membership negotiations, Law No. 4628 was accepted and entered into force on March 3, 2001. The main objective of the law was to liberate the electricity market by eliminating the legal barriers, allowing competition in generation and retail sales of electricity.

This law regulated electricity generation, transmission, distribution, wholesale, import and export, and the rights and obligations of organizations that would engage in these activities by creating a stable and competitive electricity market. License regime was implemented, requiring parties to acquire the license appropriate for the activity they wanted to conduct.

The law also determined the procedures to be followed in the privatization of electricity generation and distribution, and it was envisaged to establish a new institution, EMRA.

EMRA is the regulatory body that oversees the energy markets in Turkey. It is an “independent regulatory authority[8]” that has a number of duties in not only electricity market, but also in other fields of energy such as natural gas and petroleum markets. Some of the duties of EMRA regarding electricity market are:

- To make the necessary arrangements to ensure reliable, high-quality, stable and low-cost electricity services to consumers;

- To determine and enforce management information systems and financial reporting standards for all license holders in accordance with generally accepted accounting procedures;

- To determine the reductions in limits relating to the definition of eligible consumer and to issue new limits until the last day of January every year;

- To determine and enforce security standards and requirements for generation, transmission, distribution companies and auto-producers and auto-producer groups;

- To ensure the development and implementation of an infrastructure that allows for implementation of new trading mechanisms and sales channels depending on market development;

- To examine and approve various tariffs, such as wholesale price tariffs, distribution tariffs, transmission tariffs and retail tariffs drafted by the license owners;

- To develop model agreements where deemed necessary;

- To oversee the activities and practices of legal entities operating in the market, as well as their compliance with the terms and conditions of their respective licenses, in order to ensure compliance with non-discrimination and transparency standards;

- To establish and enforce standards and rules for relations and conducts among affiliates, in order to promote competition and in case such standards require introduction of additional restrictions on cross - ownership and operational and accounting issues related to market activities, to determine such restrictions;

- With regard to the environmental effects of the electricity generation operations, to take necessary measures for encouraging the utilization of renewable and domestic energy resources and to initiate actions with relevant agencies for provision and implementation of incentives in this field.

Electricity Market Law No. 6446

By considering the developments and changes in the international arena in the electricity sector, the problems experienced in the transition to the free market, ensuring the security of supply, issues related to undertakings to operate in the market, protection of consumers and similar problems, and in accordance with market requirements and developments, the new Electricity Market Law No. 6446 was officially published in the Official Gazette entered into force on 30 March 2013. This law repealed all provisions of the previous Law No. 4628, except for the provisions of EMRA’s organization, powers and duties, and introduced new regulations.

With this law, the operation of organized wholesale electricity markets and financial settlement transactions carried out in these markets and other financial transactions related to these activities are defined as “market operating activities”. EPİAŞ (Electricity Markets Operating Corporation) was established, and was given the duty to administrate and operate the wholesale electricity markets[9], as well as conducting the financial settlement transactions in these markets.The law also brought along amendments with regards to other market activities.

Electricity Market License Regulation

In Electricity Market License Regulation (License Regulation), the procedures and principles regarding pre-license and licensing practices in the electricity market and the rights and obligations of pre-license and license holders are determined. Parallel to Law No. 6446, Article 6 of the Electricity Market License Regulation lists distribution as an activity subject to license. The application and renewal procedure for obtaining distribution license and the evaluation principles of EMRA is included in Articles 20, 22 and 25 of the License Regulation.

Other Major Secondary Legislations and Energy Market Regulatory Authority (EMRA) Regulations

As a result of its duties, EMRA regularly makes new regulations that introduce various rules to the market and amends them. Below are some of the significant regulations that affect the distribution activity.

- Electricity Market Distribution Regulation determines the procedures and principles regarding the reliable and low-cost operation and planning of the distribution system and the users connected or to be connected to the system.

- Regulation on the Quality of Electricity Distribution and Retail Sales covers the rules to be followed by distribution companies, incumbent supply companies and users regarding the supply continuity, commercial and technical quality of electrical energy, and the principles and procedures regarding implementation.

- Connection and System Usage Regulation regulates the procedures and principles regarding the connection of real and legal persons to the electricity transmission and distribution system and their use of these systems and interconnection lines.

- Tariffs Regulation determines the procedures and principles regarding the preparation, examination, evaluation, amendment and approval of the tariffs subject to regulation in the electricity market.

- Balancing and Reconciliation Regulation determines the procedures and principles for balancing active electrical energy supply and demand and realization of reconciliation.

- Ancillary Services Regulation regulates the commercial procedures and principles regarding the procurement of services within the scope of ancillary services in the electricity market. Ancillary services are the services provided by the relevant real / legal persons connected to the transmission system or distribution system to ensure the reliable operation of the transmission or distribution system and the provision of electricity in required quality conditions.

- Regulation on the Measures regarding Electricity Market Distribution and Retail Sale Licenses determines the measures to be taken to protect the consumers and prevent disruption of the services.

There are also numerous other regulations such as Regulation on Measures to Reduce Losses in the Distribution System, Regulation on Examination and Inspection of the Activities of Generation and Distribution Companies Operating in the Electricity Market within the Scope of their Licenses.

5. Regulation of Electricity Distribution in Turkey

The regulation of electricity distribution has a number of aspects. Firstly, the distribution companies holding the appropriate license in their respective regions are heavily regulated in terms of their duties and obligations. This covers not only the tariffs to be implemented, but also the unbundling of the distribution services and ensuring the third parties’ access to the network.

Distribution Activity and License within the Scope of Law No. 6446

The distribution license regulated in Article 9 of the Law No. 6446 is the mandatory permission to be obtained from EMRA in order to be able to engage in distribution activity - which shows a natural monopoly character[10]. Distribution activity, which is expressed as the transmission of electrical energy through 36 kV and below lines, is carried out by distribution companies in the region specified in their license[11]. The distribution license can be granted for a maximum of forty-nine years and a minimum of ten years at a time.

License Regulation provides the principles and procedures of obtaining and renewing distribution licenses. Accordingly, while analysing the distribution license requests and renewal requests of such licenses, EMRA basically takes into account the following aspects[12]:

- Protection of consumer rights and the impact on the development of competition and the market,

- The experience and performances of the company making the application and the persons who have a direct or indirect share of ten percent or more in the company (and five percent or more in publicly owned companies),

- Opinions received from relevant institutions about the application and/or transactions that have been carried out or have been concluded about the relevant company,

It is also emphasized that in order for the distribution license to be acquired and renewed, the license holder must certify that they have obtained the right to operate the distribution system in the distribution region specified in their license. The application of the distribution license holder, who cannot prove that they have obtained the mentioned operating right, is rejected by the decision of the EMRA Board (EMRA’s decision making body).

Additionally, in multiple instances, the License Regulation also requires the opinion of the distribution license owners in a particular region where another facility is being connected to the network and thus applying for a license/preliminary license.

The rights and obligations of a distribution license holder are examined in detail below.

Duties and Authorities of the Distribution Companies

The main task of distribution companies is to deliver medium voltage electrical energy to consumers. In this regard, the distribution company is responsible for the reading, maintenance and operation of meters in the region specified in its license. In addition, within the scope of ensuring the quality of service; maintenance-repair, investment and planning of the distribution system are among the duties of the company. In addition, the distribution company is obliged to establish the necessary communication infrastructure for real-time monitoring of the energy flow, receiving and finalizing the notifications regarding the system, and planning and implementation of preventive maintenance and repair services at all stages from the entry of the electricity into the distribution system to the consumption points in the distribution area covered by its license.

Pursuant to the License Regulation, distribution license provides its holder with a number of rights.

Primarily, the distribution license allows the distribution company to carry out distribution activities in the distribution region specified in its license.

Moreover, the distribution company may also conduct complimentary non-market activities that will increase efficiency with distribution activities within the framework of the procedures and principles determined by EMRA.

Moreover, the license holder may purchase electrical energy to be used to cover technical and non-technical losses of the general lighting and distribution system and may sell the excess energy that is contracted to cover the technical and non-technical losses of the system in organized wholesale electricity markets.

Finally, the distribution license holder is able to establish and operate a facility at 154 kV voltage level to be used in distribution activities, provided that it is separately specified in the investment plan approved by the EMRA Board and the approval of TEİAŞ is obtained in the distribution region registered in its license,

The distribution license holder must fulfil the various obligations while conducting its activities.

Operating the Network: The distribution company must operate the distribution system in the region specified in its license in accordance with the competitive environment in electricity generation and sales. In this scope, it is the duty of the distribution company to intervene in all kinds of malfunctions in the network, to ensure that the network is in working condition by carrying out planned maintenance, to establish remote reading systems, and to energize the new consumption points. In addition, the distribution company provides maintenance, repair, expansion, improvement, maintenance of the electricity network and intervenes in electrical failures.

Non-discrimination: The distribution company has to provide services to all distribution system users who are connected to and/or to be connected to the distribution system, without discrimination between equal parties in accordance with the provisions of the relevant legislation. This includes providing distribution services to all legal entities holding supply licenses without discrimination among equal parties in retail sales activities carried out in its region.

Neutrality: The distribution company is obliged to direct eligible consumers to any supplier (particularly the incumbent supplier), and in case eligible consumers want to change their suppliers, to provide the necessary services and information within the framework of the relevant legislation.

Unbundling: The distribution company cannot be a direct partner of other legal entities operating in the market, cannot have legal entities operating in the market as shareholders in its partnership structure, and cannot engage in any activity other than distribution activity (except for non-market activities that will increase efficiency with distribution activities within the framework of the principles and procedures determined by the EMRA Board).

Meter Reading: The distribution company is to carry out the installation, maintenance and operation services of the meters of the consumers connected to the distribution voltage level in the region specified in the license, to read the meters in the said region and to share the obtained data with the relevant suppliers and the market operator, and to take over the meters owned by current users.

Investment: The distribution company has to prepare the projects of the distribution facilities included in the investment program in accordance with the investment plan approved by the EMRA Board, to make the necessary improvement, renewal and capacity increase investments and/or to build new distribution facilities, has to make investments that will ensure that the distribution service is provided, and has to prepare investment plans in line with the demand forecasts approved by the EMRA Board and submitting them to the Board for approval.

Conducting Ancillary Services: The distribution company must also provide ancillary services in line with the provisions of the relevant regulation.

Providing Information to Suppliers: Another duty of the distribution company is to provide, upon request, the information necessary for the supply companies to fulfil their obligations under the relevant legislation.

Providing Tariff Proposals: The distribution company must submit the relevant tariff proposals to EMRA within the framework of the provisions of the Electricity Market Tariffs Regulation.

Preventing Losses: It is a duty of the distribution company to minimize the distribution system losses.

Demand Forecasts: The distribution company is obliged prepare demand forecasts for the region registered under the license within the framework of the relevant regulation.

Distribution in Organized Industrial Zones: The distribution company must also carry out the distribution activities within the approved borders of the organized industrial zone that does not have an OIZ distribution license.

Compensation: Within the framework of the relevant legislation, the distribution company has to compensate for damages arising from system operation and determined to be caused by poor quality and/or interruptions of electrical energy.

Capacity Publishing: The distribution company has the duty to publish the capacities of the regional production facilities that can be connected to their systems on the basis of connection point and / or regional basis every year until April 1, for the following five years and for the following ten years.

General Lighting: It is within the duties of the distribution company to provide general lighting and energy needs due to technical and non-technical losses.

Paying License Fees: The distribution company is required to pay the prices determined in the tariff.

Record Keeping: The distribution company must keep records of all real and legal persons connected to the distribution system, and keep peak requests and monitoring meter records.

Giving Opinions: The distribution company has to give the opinion requested by EMRA about whether the connection of the generation facility to be established to the distribution system is possible, together with its justifications, in due time.

Tariffs and Customer Groups

As indicated above, one of the obligations of the distribution company is to draft yearly distribution tariffs which will in turn be reviewed by EMRA and approved if deemed appropriate.

Accordingly, distribution system users pay distribution fees within the scope of tariffs implemented. Distribution system users are categorized as industrial customers, business customers, residential customers, agricultural irrigation customers and general lighting customers. There are two different distribution fee classes applied to users connected to the distribution system. These are double term tariff class and single term tariff class[13].

Double-term tariff is a tariff class based on the principle of (i) charging distribution fees based on the electrical energy amount (kWh) drawn from the distribution system or supplied to the distribution system, (ii) charging power fees for the power amount (kW) specified in the relevant system user’s connection agreement, and (iii) charging excess power fee for the part exceeding this specified power amount.

Industrial plants that pull impact loads and arc furnace facilities are necessarily subject to the double-term tariff class. The double-term tariff class may be applied to other users connected from medium voltage level upon their request. In addition, the double-term tariff class can also be applied to the producers connected from the low voltage level, upon their request.

Single-term tariff is the tariff class based on the principle of applying a distribution fee over the amount of electrical energy (kWh) drawn only from the distribution system or given to the distribution system. Customers who do not fall under double-term tariff are generally within the scope of single-term tariff.

The distribution tariffs include a number of different fees. These fees which are related to the use of the distribution system are based on costs incurred during the provision of the distribution service, and consist of the following:

Distribution fee is the unit price in kWh over the amount of electricity withdrawn from the distribution system from user subject to single or double-term tariff class and the amount of energy supplied by the producers to the distribution system within the scope of generation activities.

Power fee is the kW unit price collected monthly over the power specified in the connection agreement for the users connected to the distribution system subject to the double-term tariff class.

Excess power fee is the unit price of kW collected monthly over the exceeded power amount for those who are subject to the double term tariff class among the users connected to the distribution system, if they exceed the power specified in the connection agreement.

Reactive energy fee is the fee applied for the users of the distribution system who are subject to reactive energy application, in case the limits determined in relation to reactive energy are exceeded

Disposable capacity fee is the price applied to the producers on behalf of the consumers in case a special direct line is established between a production facility and its customers and/or affiliates and/or eligible consumers.

Unbundling

Unbundling is perhaps the most crucial aspect of the distribution network. It is a globally accepted principle not only in the context of electricity market but in any sort of network industry. Restructuring of vertically integrated enterprises that in sectors require compulsory network infrastructure to deliver services to consumers such as energy, telecommunications, postal and rail transport is expressed as unbundling[14].

The main purpose of unbundling is to prevent companies from cross-subsidizing between different market activities [15].

A transmission or distribution network owner who also owns generation assets or supply channels has an incentive to discriminate against other producers/suppliers and support their own generation units or supply companies. As long as competing producers and retail suppliers need access to the grid to reach their customers, the owner of the transmission/distribution network has the ability to discriminate on its own volition, for example by setting personalized high access prices, while protecting or promoting its own generation/supply company.

Accordingly, pursuant to Article 5 of Law No. 6446, it has been stipulated that legal entities operating in the market cannot directly become shareholders in a distribution company, and vice versa.

However, this was not always the case. Until 01.01.2013, distribution companies conducted not only distribution activities, but also retail sales activities. EMRA’s decision dated 01.09.2012 regarding the unbundling of distribution and retail sales activities ensured the two activities to be separated, and the latter being transferred to new companies known as incumbent suppliers, whereas the former kept the distribution activities.

Currently, unbundling includes separation of accounts and legal entities. Most importantly, distribution companies and supply companies are separate legal entities and they are obliged to keep separate accounts and records. This prevents the companies from cross-subsidizing between their distribution activities and other activities, including their subsidiaries, affiliates and parents.

Within this scope, if requested by EMRA, the distribution companies and the incumbent supply companies are obliged to notify EMRA of the measures they have taken to comply with the regulations stipulated under the License Regulation and general principles of unbundling, together with the evidential information and documents in accordance with the format determined by EMRA.

The Obligation of Providing Quality, Continuous and Regular Service within the Framework of Objectivity and Equality Principles

Since electricity cannot be stored and must be consumed simultaneously as it is generated[16], supply-demand balance must be ensured at all times. In order to ensure this, the consumers must have access to electricity without any interruptions at all times. In this scope, transmission and distribution networks have a vital role. Thus, they are tasked with ensuring continuous and regular flow of electricity[17]. Pursuant to this obligation, a distribution company must at all times provide high quality services and are liable for any damages caused by the outages[18].

Service quality is further regulated under the Regulation on the Quality of Distribution and Retail sales. Pursuant to Article 4 of this Regulation, the distribution company is responsible for the quality of the service it provides to users in the region specified in the distribution license. In this regard, the quality of the service provided in the distribution system is monitored by EMRA under three main subjects, namely (i) supply continuity quality, (ii) commercial quality and (iii) technical quality.

Supply continuity quality is the capacity to deliver electrical energy to distribution system users at economically acceptable costs and with the minimum possible downtime and frequency. Within this context, the distribution company records long and short outages that affect all or part of the distribution system, categorizes and reports them. There are objective quality criteria based on the frequency and duration of the outages listed under Article 14 of the Regulation.

Commercial quality is the capacity to fulfil the transactions in accordance with the standards to be determined by EMRA at all stages of the relationship between the users who want to connect to the distribution system or are connected to the distribution system and the parties providing services under the connection agreement or retail sales agreement. Once again, the objective minimum performance standards for which the distribution company is obliged in terms of commercial quality indicators and the compensation payments / actions to be taken regarding the violation of these standards are specified in the Regulation.

Technical quality is the capacity of the distribution system to meet the electrical energy demand of the users in an uninterrupted and high quality manner within the limits of acceptable variation in terms of voltage frequency, amplitude, waveform and three phase symmetry. It is ensured by way of the criteria listed under Article 23 of the Regulation.

A distribution company must at all times comply with the quality requirements listed above. They must provide reports to EMRA regarding their compliance, and are liable for damages should they fail to ensure quality.

Also within the context of providing quality services, one of the most important features of the distribution activity is that it must be carried out within the framework of equality and objectivity. Since there is only a single network which every generation facility and user of electricity must connect to, the dominant undertakings holding the transmission and distribution networks control the sole possibility of the transmission of electricity to consumers, and this causes the issue of ‘access to the grid’ constitutes the most important barrier to entry to the market. Given that energy networks are indispensable for energy companies operating in upstream and downstream markets, the formation of competitive energy markets depends only on companies controlling the natural monopoly grids of the energy supply chain not to act in a discriminatory manner[19].

Accordingly, pursuant to Law No. 6446, distribution companies cannot give priority to any party or treat users differently regarding connection to the distribution system and system usage. In other words, third party access to the network must be facilitated by the distribution company without any discrimination.

With the provisions of the License Regulation, it is stipulated that the distribution company cannot discriminate between equal parties regarding the connection and use of the system, demand fair conditions for claims in these matters, cannot reject the requests without sufficient justification, the claimants can make their objections to EMRA, and if deemed appropriate, the distribution company has to provide access to the grid to users.

6. Conclusion

Uninterrupted flow of electricity to consumers directly depends on the performance of the distribution network, deeming it necessary for the distribution activity to be closely monitored by the regulatory bodies. As a sector subject to market failure, that is being a natural monopoly, the electricity distribution market is always subject to regulation in all jurisdictions and Turkey is no exception.

Electricity distribution market in Turkey has shifted considerable in a rather brief period of time. What started out as a state-owned monopoly that provided the entirety of vertically integrated electric utility services were separated, liberalized, privatized and then regulated in over a couple of decades. Different models were examined, global benchmarks were utilized and market structure was designed accordingly. Electricity market laws and regulations were adopted, legal framework of thousands of pages were created, as well as a full-fledged administrative authority to keep checks and balances.

The main reason behind all these steps taken was to form a functioning, modern and competitive electricity market. Electricity distribution sector has accordingly been shaped by privatizations that aimed to both achieve operational efficiency and meet the long delayed investment requirements. Furthermore, the natural monopoly of distribution network directly affected how the retail sales segment could be opened up the competition, so regulation of the distribution companies has been necessary. Indeed, the distribution companies’ tendency to discriminate between third parties and the incumbent suppliers posed a significant entry barrier for the retail sales segment.

The current distribution structure of 21 distribution zones has been in place for 8 years, with a number of unbundling and non-discrimination efforts from both EMRA and the Turkish Competition Authority. However, the competition in the wholesale and retail sales of electricity remains in a poor state. The dynamic and ever-changing nature of the electricity market may change this state in the future. Indeed, due to growing electricity demand and delayed investments, the network require vast amount of expansion and renewal investment.

For the time being, distribution companies are under heavy regulation. Their fees are controlled by transparent tariff mechanisms, their activities are closely monitored by EMRA in terms of technical, commercial and supply continuity quality terms, and they have been separated from their sister companies of incumbent suppliers within the scope of unbundling.

As stated above, electricity distribution market must be regulated at all times due to it being a natural monopoly. Licensing requirements ensure entry to the market is prevented, tariffs ensure fair pricing and prevent monopoly pricing, quality standards ensure undisrupted and high quality flow of electricity to consumers and the overall regulatory framework allows the distribution of electricity to be closely monitored.

There are still topics of issue that require further examination and regulation, such as the power user data gives to companies, how the user data will be utilized by the distribution companies and with whom it will be shared. Indeed, user data is of utmost importance for independent suppliers to enter and operate in the electricity industry, thus deeming access to this data a mandatory asset, whereas the incumbent suppliers and distribution companies want to enjoy this privilege by themselves. Accordingly, there is still room for improvement in the regulatory framework.

Nonetheless, after three decades, two main laws, countless secondary legislations and the establishment of a regulatory authority to oversee and even micro-manage the market, the initially rushed regulations are being perfected and shaped into what an effective network industry needs.

- Akçollu, Yeşim; Elektrik Sektöründe Rekabet ve Regülasyon, Rekabet Kurumu Uzmanlık Tezi, Ankara, 2003.

- Aslan, Yılmaz et al. Enerji Hukuku, Elektrik Piyasasında Rekabet ve Regülasyon, Cilt 1, Bursa, 2007.

- Atiyas, İzak; Elektrik Sektöründe Serbestleşme ve Reform. TESEV Yayınları, İstanbul, 2006.

- Çınar, Yusuf. Elektrik Piyasasında Dağıtım Faaliyetlerine İlişkin Lisanslama Rejimi ve Denetim, Astana Yayınları, Ankara 2018.

- High Planning Council of Republic of Turkey, Electricity Energy Market and Supply Security Strategy Document, 21 May 2009.

- Jamasb, Tooraj; Nepal, Rabindra et al. Energy Sector Reform, Economic Efficiency and Poverty Reduction, The World Bank, Washington D.C., August 2014.

- Jamasb, Tooraj; Newbery, D.; Pollitt, M.. Core Indicators for Determinants and Performance of Electricity Sector in Developing Countries, World Bank Research Policy Working Paper 3599, Washington D.C., USA, 2005.

- Şahin, Yersu Selen; Enerji Sektöründe Ayrıştırma, Rekabet Kurumu, Ankara, December 2012

- Ulusoy, Ali; Bağımsız İdari Otoriteler, Turhan Kitabevi, Ankara 2003.

- The World Bank, Global Electric Power Reform, Privatization and Liberalization of the Electric Power Industry in Developing Countries Annual Review of Energy and the Environment Vol. 26 (Volume publication date November 2001), Washington D.C., USA,

End Notes

- Official Gazette dated 25.07.1970 and numbered 13559.

- Following a decision of TEK’s board of directors, Turkey was split into numerous zones where electricity distribution institutions and affiliated offices distributed electricity to consumers. For example, “Ankara İl Elektrik Dağıtım Müessesesi” was one of those institutions and was responsible for distribution of electricity in Ankara, Çorum, Kırıkkale, Çankırı and their surroundings.

- Pursuant to the Council of Ministers Decision No. 93/4789 dated 08.12.1993.

- The relevant models are generally considered as “text book” examples. (Jamasb, Tooraj; Nepal, Rabindra et all., Energy Sector Reform, Economic Efficiency and Poverty Reduction, The World Bank, Washington D.C., August 2014.)

- Privatization High Board Decision No. 2004/22, dated 02.04.2004.

- The World Bank, Global Electric Power Reform, Privatization and Liberalization of the Electric Power Industry in Developing Countries Annual Review of Energy and the Environment Vol. 26 (Volume publication date November 2001), Washington D.C., USA, p. 331-359.

- Jamasb, Tooraj; Newbery, D.; Pollitt, M.; Core Indicators for Determinants and Performance of Electricity Sector in Developing Countries, World Bank Research Policy Working Paper 3599, Washington D.C., USA, 2005.

- An independent regulatory authority is an executive administrative body that (i) is independent from the ordinary audit and supervision of the government and (ii) focuses on the regulation of a particular industry that requires expertise which could be considered extraordinary for the mainstream administrative bodies. (Ulusoy, Ali; Bağımsız İdari Otoriteler, Ankara, Turhan Kitabevi, 2003. p. 15 – 18.)

- Other than those already operated by The Istanbul Stock Exchange (BIST).

- Electricity Energy Market and Supply Security Strategy Document of the High Planning Council dated 21 May 2009

- Aslan, Yılmaz. Enerji Hukuku, Elektrik Piyasasında Rekabet ve Regülasyon, Cilt 1, Bursa, 2007, p. 330.

- Çınar, Yusuf. Elektrik Piyasasında Dağıtım Faaliyetlerine İlişkin Lisanslama Rejimi ve Denetim, Ankara 2018, p. 68.

- EMRA decision numbered 5999-3 on Procedures and Principles Regarding the Tariff Applications of Distribution Licensed Legal Persons And Incumbent Supply Companies.

- Şahin, Yersu Selen; Enerji Sektöründe Ayrıştırma, Rekabet Kurumu, Ankara, Aralık 2012, p. 8.

- Akçollu, Yeşim; Elektrik Sektöründe Rekabet ve Regülasyon, Rekabet Kurumu Uzmanlık Tezi, Ankara, 2003, p. 37.

- Atiyas, İzak; Elektrik Sektöründe Serbestleşme ve Reform. TESEV Yayınları, İstanbul, 2006. p. 27.

- Article 10 of the License Regulation.

- Article 33 of the License Regulation and Article 7 of the Regulation on the Quality of Distribution and Retail Sales. With the aforementioned provisions, the obligation to provide uninterrupted electricity is secured via sanctions.

- Şahin, Yersu Selen; Enerji Sektöründe Ayrıştırma, Rekabet Kurumu, Ankara, December 2012, p. 2-3.

All rights of this article are reserved. This article may not be used, reproduced, copied, published, distributed, or otherwise disseminated without quotation or Erdem & Erdem Law Firm's written consent. Any content created without citing the resource or Erdem & Erdem Law Firm’s written consent is regularly tracked, and legal action will be taken in case of violation.