Asset Backed Versus Asset Based Sukuk and their Application in Türkiye

Introduction

The goal of this article is to explain and compare asset backed and asset based sukuk structures and their application in Turkish leasing certificate issuance. Sukuk, an Arabic word which is the plural of Sakk, is the common name of sharia compliant bonds also referred to as Islamic bonds.[1] However, the Arabic word sukuk correctly translates to Islamic investment certificates.[2] Under the sukuk structure, sukuk holders (investors) each hold an undivided beneficial ownership in the "sukuk assets”. The Accounting and Audit Organization for Islamic Financial Institutions (“AAOIFI) defines sukuk as certificates of equal value representing undivided shares in ownership of tangible assets, usufruct and services, or (in the ownership of) the assets of particular projects.[3]

Asset backed sukuk

Asset backed sukuk involve granting the sukuk holder a share of a tangible asset or business venture along with a corresponding share of the total risk (that is, a share commensurate with this ownership). In this structure, there is a true sale transaction, where the originator sells the underlying assets to a special purpose vehicle (SPV) that holds these assets and issues the sukuk backed by them. The sukuk holders do not have recourse to the originator if payments under sukuk are less than usual. A true sale implies that the assets of the issuer will not be added to the assets of the originator in the event of default and liquidation. The sukuk holders must assume any losses in case of impairment of sukuk assets. Since the risk of profit and loss arising from the underlying asset is shared with the investor, an asset backed sukuk provides variable returns and does not carry default risk. In the Turkish application, it is a feature of this structure that the underlying assets are transferred to asset leasing company / SPV (Varlık Kiralama Şirketi) by the true sale of the source institution.[4] The sukuk holders become owners of the underlying asset through the SPV, and they also have the possibility to transfer the certificates to third parties. In the Turkish application, the underlying assets may be physical or real assets or any right to claim. As an expected effect of true sale, the underlying asset is shown in the balance sheet of the SPV.

Asset based sukuk

Asset-based sukuk involves the issuer purchasing the underlying assets and then investing, trading or leasing them on behalf of the investors, using the funds raised through the issued certificates (sukuk). In other words, asset-based sukuk are issued without the actual sale of the underlying asset. This structure usually involves a binding promise (wa'ad mulzim) from the originator to repurchase the underlying assets at maturity. More importantly, in this structure, the sukuk holders can only require the originator to purchase the underlying assets.

In this type of sukuk, the sukuk holders have beneficial ownership in the asset. The sukuk holders have recourse to the originator if there is a shortfall in payments. Beneficial ownership is a legal term meaning that specific property rights, such as use and title, belong to a person even though legal title to the property belongs to another person. A common example of beneficial ownership is the ownership of funds held by a nominee bank or for stocks held in the name of brokerage firm.[5] As such, the sukuk holders have an unsecured debt claim against the originator embodied in the payment of the purchase price following an execution of the binding purchase promise. This implies that sukuk holders do not have full recourse to the underlying assets and the underlying assets are not used as collateral. Asset-based sukuk grant only beneficial ownership to the sukuk holders, so that in case of default, the investor would be left without any claim on these assets. In this structure, the originator most often transfers to the investors only the beneficial ownership of the SPV issuer. The source of the payments to be made to the investors is not the underlying asset, but the cash flow of the source organization. In this structure, receivables are pooled and the issuance is made based on the income of such receivables. The SPV purchases the underlying asset with the source obtained from the issuance of the sukuk. Then the SPV invests, trades or leases the underlying asset on behalf of the investors. However, since investors have no recourse to the underlying assets, the structure does not give any importance to the asset risk. This structure focusses on the creditworthiness of the sponsors of the sukuk.

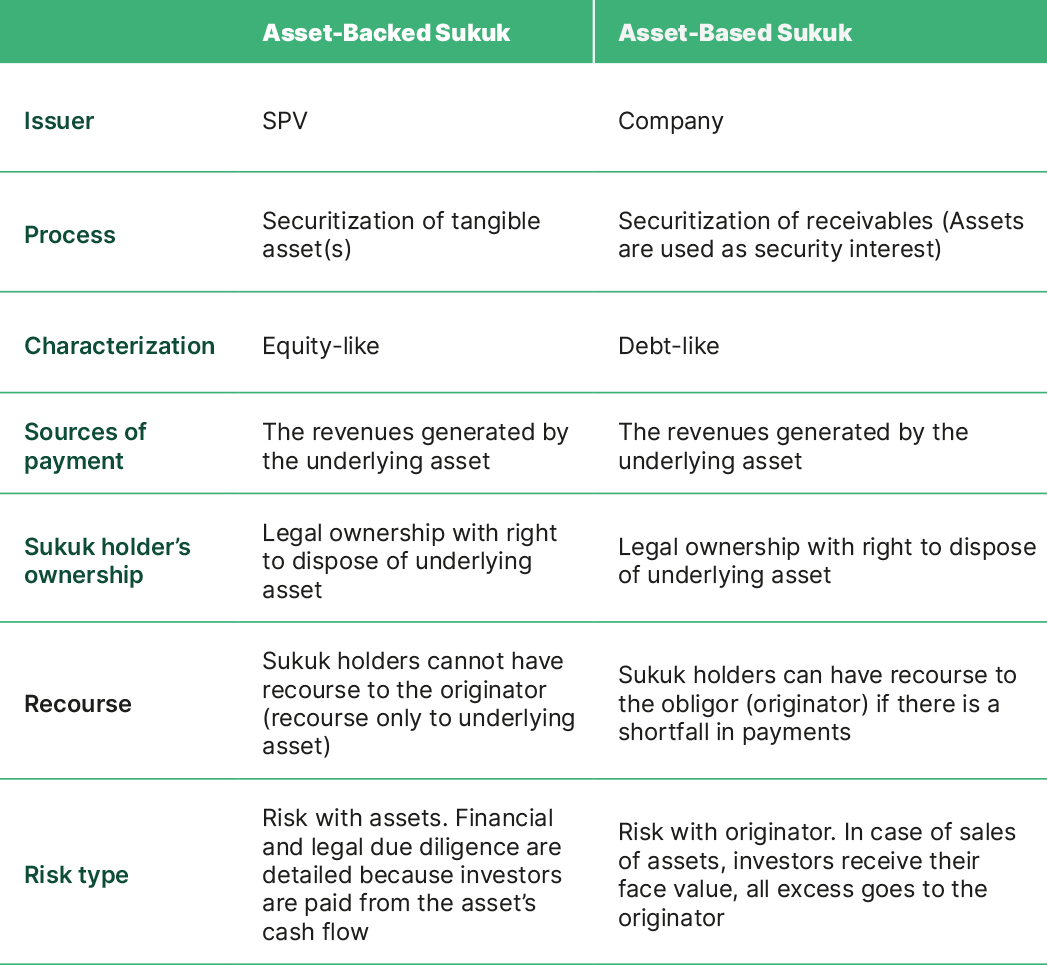

The table below shows the fundamental differences between “asset backed” and “asset based” Sukuk:[6]

Türkiye Application

Sukuk were introduced in Türkiye in 2010, under the name of “lease certificates.” They are regulated by the Communiqué on Lease Certificates numbered III-61.1 issued by the Capital Markets Board (“CMB”), based on article 61 of Capital Markets Law numbered 6362. The legislature renewed the sukuk legislation in 2013 by extending the scope of underlying assets to all kinds of rights and assets and introducing five more internationally well-known Sukuk structures: Wakalah, Murabahah, Mudarabah, Musharakah and Istisna. In 2016, tax and fee exemptions were extended with a legal amendment to cover all Sukuk. In addition, CMB has made a fifty per cent discount for the registration fees it imposed for capital market instrument issuances, including Sukuk, in 2016.[7]

Some Turkish scholars have written that Turkish sukuk legislation is under the influence of Malaysian regulations, as underlying assets can be credit rights (alacak hakkı) in CMB legislation. However, such underlaying assets are prohibited by certain other Islamic banking legislation.[8]

With reference to the structures of corporate Sukuk in Türkiye, it will be seen that they are generally based on ownership (Ijarah), trading (Murabahah) but mainly on management contracts (Wakalah). “Wakalah Sukuk” has dominated the market so much that in recent years, “Wakalah Sukuk” has had a concentration rate of more than 95% among total Sukuk issuances. Meanwhile, as an indicator of market development, Istisna Sukuk was issued for the first time in 2021.[9]

Conclusion

Asset-backed Sukuk are seen as safer in terms of being based on assets and the rights they provide to the sukuk holders. On the other hand, Asset-based Sukuk are similar to unsecured bonds in the case of an acceleration.[10] However, the Islamic financing regulations in Türkiye accept both asset based and asset backed Sukuk.

- Bafra, Erdem: İslami Bankacılıkta Sukuk (Kira Sertifikaları) ve Uygulaması, Ankara, Seçkin, 2016.p. 58

- Dr. Tahmoures A. Afshar, Compare and Contrast Sukuk (Islamic Bonds) with Conventional Bonds, Are they Compatible?, The Journal of Global Business Management Volume 9 * Number 1* February 2013, p.45

- Herzi, Ahmed Abdirahman, “A Comparative Study Of Asset Based And Asset Backed Sukuk From The Sharıah Compliance Perspective”, Access Date: 09.01.2023

- Kazancı, Fatih, “Sukuk İhraçlarına Yeni Bir Dayanak Varlık Önerisi Olarak Elektronik Ürün Senetleri (ELÜS)”, ADAM AKADEMİ Sosyal Bilimler Dergisi, 11(1), 169-202 DOI: 10.31679/adamakademi. 769474

- Afshar, p.45

- https://investment-and-finance.net/islamic-finance/questions/what-is-the-difference-between-asset-backed-sukuk-and-asset-based-sukuk.html Access Date: 09.01.2023

- IIFM Sukuk Report, “A Comprehensıve Study of the Global Sukuk Market”, August 2022 | 11th Edition, https://www.iifm.net/frontend/general-documents/b387b56a6a4c664ff1fa2bc16f2ef1be1662443654.pdf, p.191, Access Date 09,01,2023

- Gölcüklü, İlyas: “iii-61.1 Numarali SPK Tebligi Acisindan Kira Sertifikalari ve Sukuk”- Batider, December 2016, Tome: 32, No: 4, https://www.lexpera.com.tr/literatur/batider-makaleler/iii-61-1-numarali-spk-tebligi-acisindan-kira-sertifikalari-sukuk-ii-kira-sertifikalari-ve-sukuk/ Access Date: 09.01.2023

- IIFM Sukuk Report, p.193

- Aslan, Hakan: “Alternatif Bir Yatırım Ve Finansman Aracı Olarak Sukuk: Yapısı, İşleyişi Ve Türkiye Piyasası İçin Öneriler”, Yüksek Lisans Tezi, Marmara Üniversitesi Sosyal Bilimler Enstitüsü, 2012, p. 67

All rights of this article are reserved. This article may not be used, reproduced, copied, published, distributed, or otherwise disseminated without quotation or Erdem & Erdem Law Firm's written consent. Any content created without citing the resource or Erdem & Erdem Law Firm’s written consent is regularly tracked, and legal action will be taken in case of violation.

Other Contents

Interest constitutes the consideration granted to a monetary creditor for the period during which they are deprived of the use of their funds within a debtor–creditor relationship. In this sense, interest serves as a legal mechanism of compensation aimed at preserving the value of the creditor’s assets. Particularly…

The financial sector is undergoing a major transformation in response to global sustainability goals. Within this shift, the banking industry plays a pivotal role thanks to its guiding influence and transformative power—making it a key driver in the transition to a green and sustainable economy...

Open banking involves making data in the financial system accessible to authorized third-party service providers (“TPPs”) through standard Application Programming Interfaces (“APIs”). It enables customers to share their financial data so that financial institutions can develop new technologies and make...

The European Commission (“Commission”) has published the Proposal for a Directive of the European Parliament and of the Council on Payment Services and Electronic Money Services in the Internal Market amending Directive 98/26/EC and repealing Directives 2015/2366/EU and 2009/110/EC. This proposal...

Organization for Economic Co-operation and Development (“OECD”) has published its paper[i] presenting an outline of the diverse frameworks implemented for open banking and other data sharing arrangements in different jurisdictions, discussing expansion of open banking related data arrangements, which is referred...

In September, the Central Bank of the Republic of Turkey (“CBRT”) published the Guide on Associating Business Models in the Field of Payments with Payment Service Types (“Guide”). The Guide includes explanations regarding payment services and electronic money issuance. An operating license is required...

The Banking Regulation and Supervision Agency (“BRSA”) published the Circular on the Disclosure of Confidential Information Regulation No.2022/1 (“Circular”) on 11.08.2022. The purpose of this Circular is to elaborate on concepts and procedures as outlined in the Regulation on Disclosure of...

Public-private partnerships (“PPP”) take a wide range of forms varying to the extent of involvement of, and risk taken, by the private party. The terms of a PPP are typically set out in a contract or agreement, often subject to the private law, to outline the responsibilities of each party and allocation of risk...